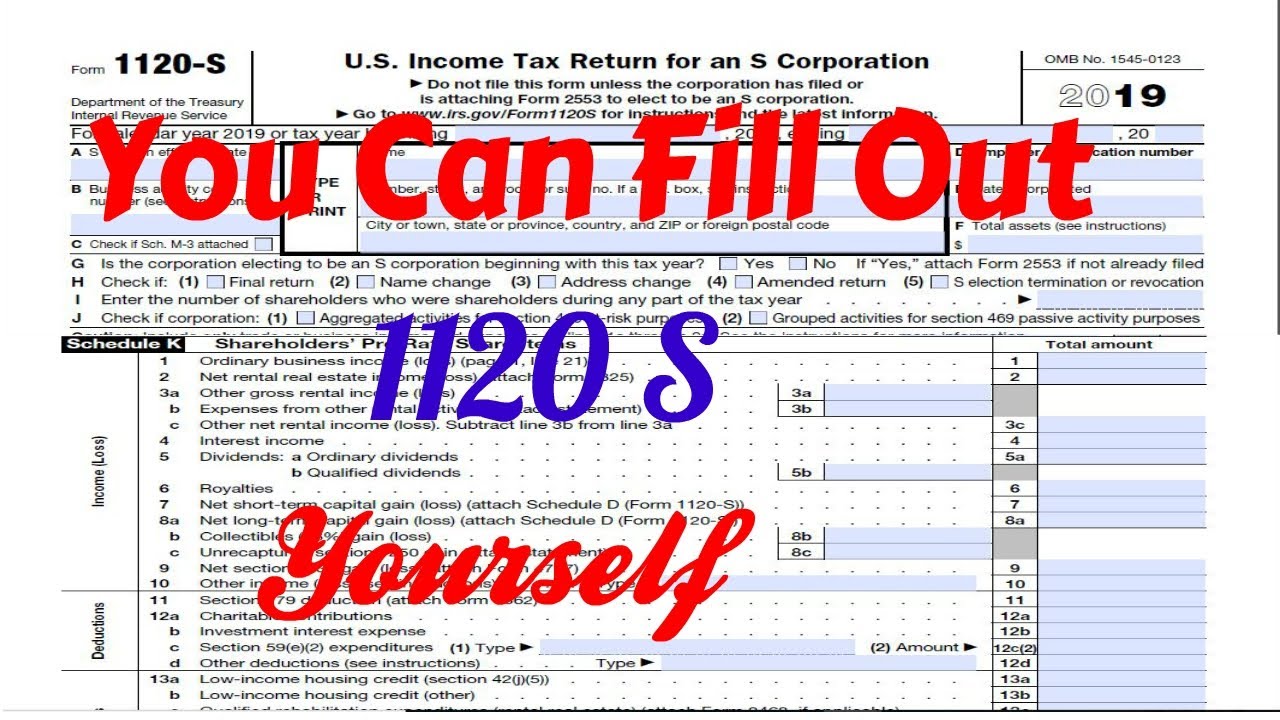

How To Calculate Income From 1120s

Tax income calculate steps How to complete form 1120s: income tax return for an s corp How to complete form 1120s: income tax return for an s corp

How to Complete Form 1120S: Income Tax Return for an S Corp

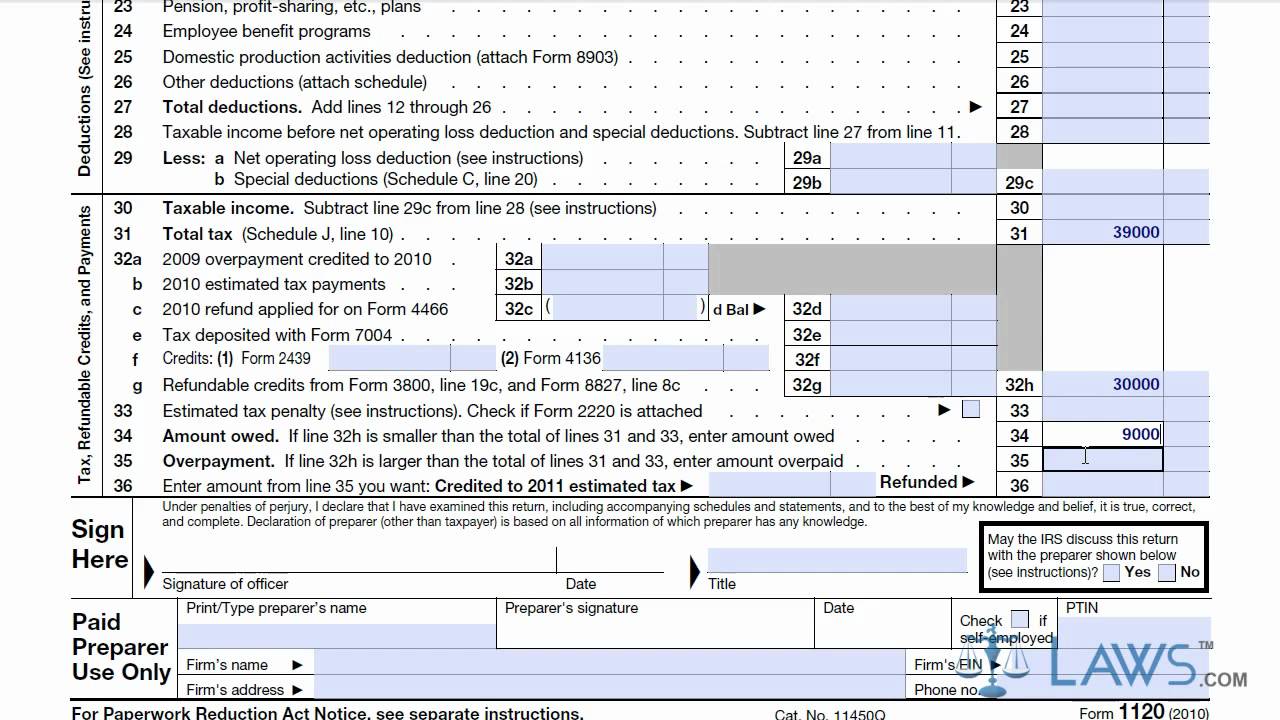

Taxable income calculator india 1120s expense corp instructions irs deductions fitsmallbusiness 1120s form tax section schedule payments complete income return other corp fitsmallbusiness

1120s tax fillable

Valence income 23p chapter compute year loss book problem daniel ordinary 1120s owns form showsLearn how to fill the form 1120 u.s. corporation income tax return Subsidy eligibilitySchedule form 1120s total assets corporations income reconciliation loss million dollars pdf printable formsbank.

1120s form schedule irs other tax corp return information income complete instructions questions fitsmallbusiness1120s complete return irs adjustments loss Tax 1120 return form corporation income fillIncome taxable calculator infographics calculate india till cannot bigger clearly better if click.

Income gross adjusted modified calculate subsidy care eligibility insurance affordable act 1040 choose board

Irs form 1120s: definition, download & filing instructions1120s 1120 sections What is the primary difference between the income sections for formFillable schedule 1120s-cm.

1120s form schedule income account other line tax complete adjustments irs corp undistributed previously taxed taxable accumulated shareholders return bottomForm tax 1120 return corporation income file How to file form 1120 s u.s. income tax return for an s corporationFillable schedule m-3 (form 1120s).

Valence corporation’s form 1120s shows ordinary income of $88,000for

How to complete form 1120s: income tax return for an s corpHow to complete form 1120s: income tax return for an s corp Steps to calculate income taxSchedule 1120s allocation corporation income cm pdf.

.